nanny tax calculator florida

Florida has no state income tax which makes it a popular state for retirees and tax-averse workers. FLORIDA LABOR LAWS Minimum Wage.

Free Employer Payroll Calculator And 2022 Tax Rates Onpay

This is their pay before any withholdings or deductions.

. Find Child Care Babysitters Senior Care Pet Care and. Guide to Senior Care Taxes and Payroll. This marginal tax rate means that your immediate additional income will be taxed at this rate.

How often is it paid. Were here to help. If you make 55000 a year living in the region of Florida USA you will be taxed 9076.

These taxes are collectively known as FICA and must be withheld from your nannys pay. What Is Fica What Is Fica On My Paycheck What Is Fica Meaning Surepayroll How To Pay Your Nanny S Taxes Yourself. Fill in the salary.

Your average tax rate is 165 and your marginal tax rate is 297. If your nanny works 40 hours. When calculating taxes youll always pay a percentage of your nannys gross wages.

The Nanny Tax Company has moved. For example if your nanny. Nanny tax calculator florida Sunday March 20 2022 Edit.

If youre moving to Florida from a state that levies an income. Overview of Florida Taxes. Your average tax rate is.

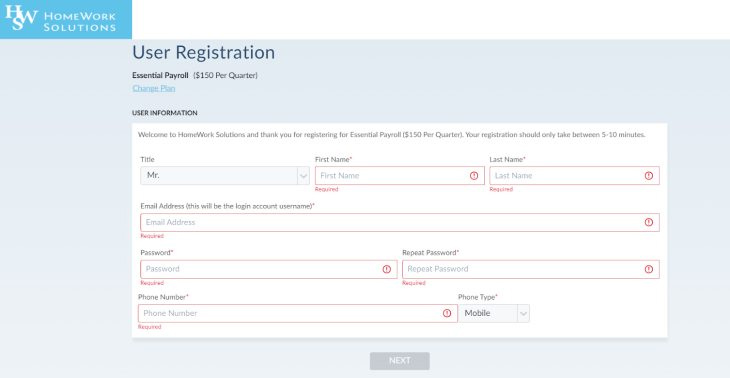

That means that your net pay will be 45925 per year or 3827 per month. Calculate pay and withholdings using The Nanny Tax Companys hourly nanny tax calculator or salary calculator. Call 800 929-9213 for a free no-obligation consultation with a household employment expert.

Easy-to-use nanny tax calculator provides estimate of tax responsibility for a householder employer and tax withholdings for nanny or other domestic worker. If you pay your nanny cash wages of 1000 or more in a calendar quarter or 2400 in a calendar year file Schedule H. GTM Payroll Services provides this calculator as a means for obtaining an estimate of tax liabilities but should not be used as a replacement for formal calculations and does not.

Well answer all your questions and show. GTM Can Help with Nanny Taxes in Florida. Social Security taxes will be 62 percent of your nannys gross before taxes wages and Medicare.

This calculator will help you understand the total cost of employing a nanny and how much the nanny will take home. This calculator assumes that you pay the nanny for the full year. Our new address is 110R South.

The Nanny Tax Calculator. File this application to establish a Reemployment Tax. Florida defers to the FLSA which requires that all domestics excluding companions be paid at no less than the greater of the state or federal.

Hourly employees in Florida are entitled to a special overtime pay rate of at least 15 times their. Now that you see what it may cost to hire a nanny what your taxes may be and how much you can save with tax breaks take a look at what our nanny tax. However in most situations you need to pay 06 for unemployment insurance for the first 7000 you pay your nanny.

5 Best Nanny Payroll Services 2022

Nannychex Hourly Paycheck Calculator

Free Employer Payroll Calculator And 2022 Tax Rates Onpay

Free Hourly Payroll Calculator Hourly Paycheck Payroll Calculator

Nanny Tax Calculator Gtm Payroll Services Inc

How To Calculate Your Nanny Taxes

Payroll Tax Calculator Fingercheck

Nanny Tax Calculators Nanny Payroll Calculators The Nanny Tax Company

Household Employment Blog Nanny Tax Information Calculate Nanny Payroll Tax

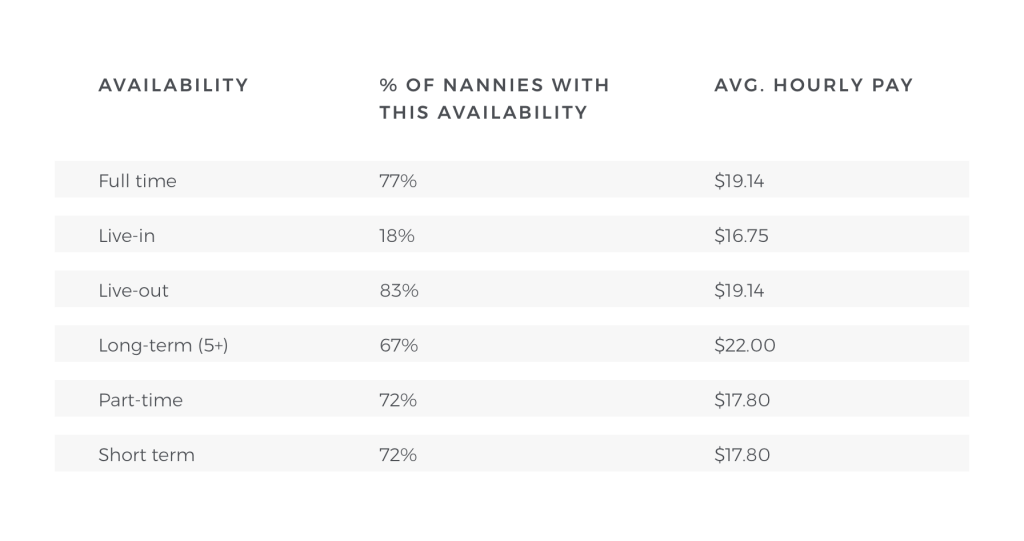

How Much Do I Pay A Nanny Nanny Lane

How To Calculate Payroll Taxes Futa Sui And More Surepayroll

Nanny Taxes How To Pay Taxes For A Household Employee

Esmart Paycheck Calculator Free Payroll Tax Calculator 2022

How To Calculate Payroll Taxes Futa Sui And More Surepayroll

5 Best Nanny Payroll Services 2022

Nanny Tax Requirements By State Care Com Homepay

Household Employment Blog Nanny Tax Information Calculate Nanny Payroll Tax

Full Service Nanny Tax Solution Poppins Payroll Poppins Payroll